The good news for art enthusiasts and those with investing power and savvy is that “blue chip” art can be a strong investment—and it may be far more accessible than you think.

The blue chip art market has shown surprising resilience amid some of the most uncertain and disruptive economic events in recent memory. The art market’s steady performance in the face of global financial turbulence has gotten art buffs, investors, and the general public talking more about art as a viable investment.

The good news for art enthusiasts and those with investing power and savvy is that “blue chip” art can be a strong investment—and it may be far more accessible than you think. Here is what you need to know about the ins and outs of blue chip artists and art, how it compares to the stock market, and how to invest in it.

The good news for art enthusiasts and those with investing power and savvy is that “blue chip” art can be a strong investment—and it may be far more accessible than you think. Here is what you need to know about the ins and outs of blue chip artists and art, how it compares to the stock market, and how to invest in it.

What Is Blue Chip Art?

In poker, the blue chips are usually the most valuable ones. The same goes for blue chip art. The term refers to authenticated art that significantly increases in value, making the owner substantial money in resale value regardless of how the economy is performing.

While blue chip art includes pieces by historically important artists with household names, “blue chip” is not about artworks’ intrinsic, personal, or cultural significance. Blue chip just means that the art has proven to have considerable worth at auction and thus stands to be worth even more money over time.

While blue chip art includes pieces by historically important artists with household names, “blue chip” is not about artworks’ intrinsic, personal, or cultural significance. Blue chip just means that the art has proven to have considerable worth at auction and thus stands to be worth even more money over time.

Who Is a Blue Chip Artist?

The defining characteristic of blue chip artists is that they create artwork that fetches high prices that investors trust to increase over time.

Only in very rare cases will everything an artist ever made become hugely sought after and desirable. The defining characteristic of blue chip artists is that they create artwork that fetches high prices that investors trust to increase over time—without being impacted by other outside economic forces. Simply, someone is a blue chip artist if buying and selling their pieces is reliably profitable.

Here are some of the top blue chip artists right now:

Here are some of the top blue chip artists right now:

- Pablo Picasso

- Andy Warhol

- Claude Monet

- Jean-Michel Basquiat

- Qi Baishi

- Zao Wou-Ki

- Gerhard Richter

- Wu Guanzhong

- Fu Baoshi

- Amedeo Modigliani

How to Invest In Blue Chip Art

Like other investments, it takes time, effort, and insight to make worthwhile returns on blue chip art. As part of your due diligence, take these steps before you start investing:

1. Be Informed

Since you already have an appreciation and passion for art, you are already poised to move forward with your interests in investing. Harness that love of art into a wide breadth of knowledge about art styles, techniques, and history. Position yourself to refine your sense of taste, and your ability to evaluate and discuss art in detail.

Know the indirect costs of buying and owning blue chip art, and continually research the art market itself to stay informed on how a particular artist or piece of artwork may change in value and worth.

Thorough preparation will make you less likely to lose money and more likely to choose profitable blue chip paintings or other pieces. Remember that there are no guarantees, and your art investment still may not turn a profit. However, by making investment decisions backed by a robust art background and appreciation, you can rest assured that you own art you can be proud of because it is valuable to you.

Know the indirect costs of buying and owning blue chip art, and continually research the art market itself to stay informed on how a particular artist or piece of artwork may change in value and worth.

Thorough preparation will make you less likely to lose money and more likely to choose profitable blue chip paintings or other pieces. Remember that there are no guarantees, and your art investment still may not turn a profit. However, by making investment decisions backed by a robust art background and appreciation, you can rest assured that you own art you can be proud of because it is valuable to you.

2. Be a Well-Rounded Investor

Art should never be your only investment, and you should not depend on it for an income. Rather, the purpose of investing in blue chip art is to diversify a portfolio, protect wealth from market volatility, and mitigate financial risk.

Ideally, art will comprise a small ratio of your investment portfolio alongside a variety of other asset classes. A diversified portfolio means that if the art’s value decreases or fails to grow it will not be the end of the world. Also, invest in a range of styles and artists to improve the odds of making returns on your investment and spreading out your exposure to risk.

Ideally, art will comprise a small ratio of your investment portfolio alongside a variety of other asset classes. A diversified portfolio means that if the art’s value decreases or fails to grow it will not be the end of the world. Also, invest in a range of styles and artists to improve the odds of making returns on your investment and spreading out your exposure to risk.

3. Be Patient

Blue chip art is a long-term investment. Gains usually accrue over decades, and art’s illiquidity makes it slow to sell and convert into cash. Therefore, successful investors hold onto blue chip art for decades or even longer, and some never end up selling. In fact, it is common to use art in estate planning to preserve wealth over many years as an inheritance.

4. Consult Professional Expertise

Art industry professionals like advisors can help guide successful investment decisions. These services are not free. But they may pay off by maximizing your chances to jump on high-potential artwork before it greatly appreciates.

5. Know Where to Invest

For beginners, it is wise to start small. Look into various art investment fund platforms to decide which one is right for you. You do not need millions to invest in world-class art if you use a crowdfunding platform. Minimum investment amounts differ, but you can get in on some of the most lucrative art pieces by owning fractional shares of blue chip artwork.

Immerse yourself in the art world. Frequent galleries and auctions, current art circles, and events. They might tip you off on the next big investment opportunities.

Immerse yourself in the art world. Frequent galleries and auctions, current art circles, and events. They might tip you off on the next big investment opportunities.

Blue Chip Art vs. The Stock Market

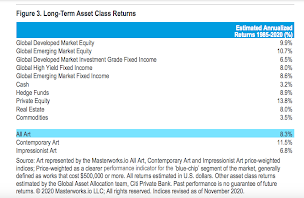

The markets for blue chip art and stocks are generally unrelated. As a result, the art market tends to retain or gain value despite inflation and stock market downturns. For example, between 1985 and 2020, high-value art has seen annual returns averaging 8.3%. Long-term, the art market performs similarly to high yield bonds, outperforming some other asset classes.

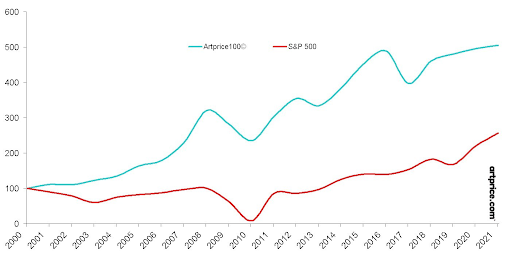

The Artprice 100 is an annually adjusted blue chip representation of the top 100 highest-performing artists at auction. Artprice 100 survived 2008 relatively unscathed compared to the S&P 500. And when the economy and the art industry collectively struggled under the weight of the pandemic, the art index increased 1.8%. Overall, blue chip art has proven itself to be a stable and secure financial investment.

DotRed and the Future of Art Investment

Online engagement is how the art industry rescued itself from the cultural and financial perils of 2020 and 2021. As the world pushes further into digital experiences, online platforms and virtual spaces are increasingly becoming the future of art.

DotRed is leading this migration into virtual art appreciation and investing by offering industry-disrupting online art exhibitions that are revolutionizing how people interact with art and artists. Our hybrid virtual art gallery is your portal to the future of making, exploring, and investing in art.

DotRed is leading this migration into virtual art appreciation and investing by offering industry-disrupting online art exhibitions that are revolutionizing how people interact with art and artists. Our hybrid virtual art gallery is your portal to the future of making, exploring, and investing in art.