Galleries and museums exploring the digital landscape must attract and hold the attention of a targeted audience.

Art is a strong alternative investment class with unique benefits and challenges. Yet many investors overlook starting an art collection, because they associate art investing with the ultra-wealthy.

The prices and complexities of the art market can indeed be a hurdle to investing. But interest and expertise in art and a well-thought-out investment strategy can make collecting art a smart financial move.

Before deciding whether art investing is right for you, read about the potential risks and rewards, how art investing works, and how to start an art collection.

The prices and complexities of the art market can indeed be a hurdle to investing. But interest and expertise in art and a well-thought-out investment strategy can make collecting art a smart financial move.

Before deciding whether art investing is right for you, read about the potential risks and rewards, how art investing works, and how to start an art collection.

Is Art a Good Investment in 2021?

As a tangible asset, art has strengths and weaknesses. For example, obtaining art through dealers and auction houses, storing, and maintaining physical pieces has extra costs. Collecting art at lower prices by less established artists runs the risk that the art never gets critic or buyer attention to gain value and keep up with inflation.

However, within a well-rounded investment portfolio containing less risky assets, high-value art can diversify a portfolio, reducing overall volatility and risk. Since art usually at least retains its value despite inflation, it can also act as an inflation hedge for portfolios. This makes art collecting attractive during 2021’s economic inflation.

Additionally, art market value is independent of other markets such as stocks and bonds. So starting and building an art collection can help preserve wealth because when markets perform poorly, art tends not to lose value like traditional equities.

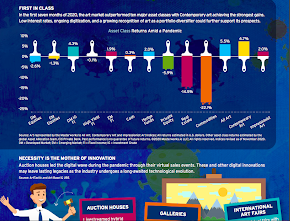

With all the economic uncertainty resulting from the Covid-19 pandemic, art may be a safer bet for some investors. During the economic turmoil in the first half of 2020, art investments surprisingly outperformed several asset classes. Some reports say that from 1985 to 2020, art investments yielded estimated annualized returns of 8.3% and considerably outpaced the S&P 500 for the past 20 years.

However, within a well-rounded investment portfolio containing less risky assets, high-value art can diversify a portfolio, reducing overall volatility and risk. Since art usually at least retains its value despite inflation, it can also act as an inflation hedge for portfolios. This makes art collecting attractive during 2021’s economic inflation.

Additionally, art market value is independent of other markets such as stocks and bonds. So starting and building an art collection can help preserve wealth because when markets perform poorly, art tends not to lose value like traditional equities.

With all the economic uncertainty resulting from the Covid-19 pandemic, art may be a safer bet for some investors. During the economic turmoil in the first half of 2020, art investments surprisingly outperformed several asset classes. Some reports say that from 1985 to 2020, art investments yielded estimated annualized returns of 8.3% and considerably outpaced the S&P 500 for the past 20 years.

How Do Art Investments Work?

Art is like any other investment in that you want the asset to appreciate so you can profit. The most essential factor determining if pieces increase in value is their quality, however subjective it may seem.

Thus, the largest and most dependable returns come from ‘blue chip’ art. ‘Blue chip’ refers to masterpieces by historic or otherwise iconic artists whose work has indisputable value, often in the millions. So in art investing, it does not hurt to have millions to spend.

Most investors do not realize that starting an art collection is not reserved for millionaires and billionaires. Depending on one’s means, art by emerging or mid-career artists can be a worthy investment. Therefore, learning how to invest in art can be financially practical for those who understand:

Thus, the largest and most dependable returns come from ‘blue chip’ art. ‘Blue chip’ refers to masterpieces by historic or otherwise iconic artists whose work has indisputable value, often in the millions. So in art investing, it does not hurt to have millions to spend.

Most investors do not realize that starting an art collection is not reserved for millionaires and billionaires. Depending on one’s means, art by emerging or mid-career artists can be a worthy investment. Therefore, learning how to invest in art can be financially practical for those who understand:

- Art investments are illiquid. That means it can be difficult and time-consuming to convert art investments to cash. So starting and building an art collection is a long-term investment.

- Art market returns behave similarly to bonds- slow and steady appreciation that you cannot count on to turn a profit every quarter. Art typically does not experience sudden explosions like cryptocurrency. Rather, art investors normally realize returns after holding for decades.

- It takes extensive art world knowledge and research to start an art collection worth investing in. The volatile art market determines newer artworks’ value, especially for those starting an art collection on a budget and looking at current artists. Artists’ reputations and the art world’s demand for their work might fluctuate unpredictably, so there are no guarantees.

- In the case of physical art pieces, you must pay for care and storage. Otherwise, the art will deteriorate and depreciate.

How to Start Investing In Art

There is a litany of ways to buy art as an investment. Before you start collecting art, know what it takes, what you want, and strategize a long-term plan accordingly:

Have Enthusiasm and Expertise

Once you actively start and build an art collection, you will almost certainly be stuck with the art for a long time. Go after pieces you genuinely love aesthetically regardless of investment value. Passion for art is a prerequisite. Art investing requires time and effort to refine your taste, research the market, and hunt down additions to your collection while evaluating art quality, cultural/historical significance, and artists’ potential.

Decide on a Type of Art

Do you have the funds and know-how to purchase ‘blue chip’ or contemporary physical pieces? Do you have a taste for paintings, photos, sculpture, or street art to build a cohesive collection? Are you interested in digital art or NFTs?

Find Your Marketplace, Platform, and Method

Your level of art expertise and the type of art you want will direct where and how you source your collection, but always seek professional advice regardless:

- Primary vs. Secondary Markets-

In primary art markets, you buy directly from the artist sometimes at a fair or gallery, either in person or online. You are the first person ever to buy a given piece.

In secondary markets, someone has already bought the art to resell it. You purchase through a dealer or an auction house such as Sotheby’s or Christie’s (which also process online transactions) for an additional buyer’s premium, which can be up to 30%.

It is less costly to buy from the artist themself, via social media for example. But going through a gallery, dealer, or especially an auction house has the security advantage of experts predetermining a work as valuable. - NFT Marketplaces-

NFT marketplaces are ideal for beginners because they can buy art for less and benefit from the authenticity, transparency, and greater liquidity blockchain provides. You may need to acquire cryptocurrency to buy digital art or NFTs on certain platforms. - Art Investment Funds-

Knowledgeable fund managers buy and sell art investments for you.

Art Indices-

To make sure you invest in high-demand artists, an art index compiles the past five years’ top 100 auctioned artists. - Fractional Art Investment-

Buying shares in artwork through fractional investment is another easy and affordable entry point for new investors. Some platforms allow you to get in for under $1,000 with a degree of liquidity.

Take Proactive Ownership

For physical art, budget in professional framing, maintenance, and storage. Regularly display pieces from your collection to access art circles and events and develop notoriety. For physical and digital art, take advantage of every chance to make connections with art industry insiders. They can help you grow your expertise and ongoing investment opportunities.

DotRed and the Future of Art Investment

The rise of online and digital art buying is opening new doors for artists, enthusiasts, collectors, and investors. At DotRed, we curate a hybrid in-person, virtual, social, and multisensory gallery experience. Our mission is to welcome today’s art world changes and empower all art lovers to live more imaginative lives, through creating and appreciating art, starting art collectives, and supporting artists by investing in their work.